The foreclosure survival guide

Here’s an overview of the parties and terminology involved

Why are local area home prices so high?

A basic explanation to this frustrating question.

Are there problems with minors in title?

There are times when a minor is in title to real estate.

Interest rate increases

Rate hikes likely to impact home mortgage rates

Can You Buy Your Home With Bitcoin?

Can you use Bitcoin to buy a home? Up until recently, the answer was “no.”

King County Property Tax Increase

King County property taxes are going up by double-digit percentages.

The New 2018 Tax Law

If you own property, here’s what you can expect

New Roof: Best Investment

One of the main reasons home-owners invest in remodeling is to increase the value of the home.

What Is An ‘Escrow’?

Escrow holds legal documents and funds on behalf of a buyer and seller and distributes them according to instructions.

Documents required for loan

Income and Asset verification and other requirements.

Closing a loan

When people talk about a real estate purchase or refinance, they sometimes use the terms “signing” and “closing” interchangeably.

Are there problems with minors in title?

There are times when a minor is in title to real estate. Maybe the deed from Mom & Dad says “Susan B. Jones, a minor.” Or, when she shows up to sign papers, the real estate broker notices the nanny who brought her in. Of course, a child can inherit property. The parents never intended for the child to own it so soon, but it happens.

Most of us know there may be a problem, but what is it, exactly? Can little Suzie even be in title? Can she convey or mortgage the property? How?

Well, yes a minor can be in title, and it happens all the time. That’s not the problem – if she doesn’t want (or need) to sell or mortgage the property now, she will eventually be old enough to do something with it.

But until Suzie reaches the legal age of majority, she is under a type of “disability” because she lacks the capacity to enter in to binding contracts. If she signs title away when she is 17, she can disavow it when she reaches the age of majority and for some time thereafter.

WHAT IF A MINOR NEEDS TO SELL OR MORTGAGE THE PROPERTY?

The only way for Suzie to sell or take out a mortgage is for someone to go to court, open a guardianship, appoint a guardian, get a court order authorizing the transaction, and have the guardian execute the deed or mortgage. Also, if a guardian has been appointed in another state, an ancillary court proceeding will be needed because the foreign court does not have jurisdiction in Washington.

All this can be expensive and time consuming and pretty onerous if the transaction has to happen now. But, there is no alternative – the horse is already out of the barn, so to speak. The conveyance to Suzie (or her inheritance) can’t be undone.

OTHER WAYS FOR A MINOR TO OWN REAL ESTATE

There are other more practical ways to deal with children owning real estate. One is a trust, where title is conveyed to the trustee of the trust, or the trust is set up in a probate. In that case, the title company will need to see the trust document or the will.

A custodianship pursuant to RCW 11.114 is a simple alternative. In that case, title is conveyed to an adult of legal age: “John Paul Jones, as custodian for Susan B. Jones, under the Washington Uniform Transfers to Minors Act.” The statute provides for only one custodian per child per deed, and a trust company can be named as well, if the trust permits it. It used to be called the Uniform Gifts to Minors Act, and you might see this recital in a deed coming from another state. A deed can be accepted from a custodian in any state, which need only recite the adult custodian, the custodianship and the name of the minor.

When title is vested in a custodian, title insurers do not need to call for any proof of authority or documentation. This is an advantage of a custodianship over a guardianship for all concerned. Acknowledgments for a custodian would be for the adult individual, because there is no documentation to present to the notary, while a guardian would use the representative capacity (for a fiduciary) form.

Of course, during the custodianship the adult has a fiduciary responsibility to the minor, and can’t dispose of or use the assets for personal gain. The money from a sale of a house would still belong to the minor. But third parties, including title companies, don’t need to question where the money will end up.

WHAT HAPPENS WHEN THE MINOR REACHES LEGAL AGE?

Once the minor reaches 18, 21 or in some cases 25 years of age (it all depends on the circumstances of the transfer), the custodian is to convey the property to the minor. But as an adult she can deal with the property in her own name. With a guardianship, the court action needs to be closed, and the property distributed to the minor. A custodianship is a convenient way for a minor to hold title, but there can be estate planning and taxation ramifications when children own real estate. An attorney should always be consulted if a minor is or will be in title.

| Custodian Washington has adopted the Uniform Transfers to Minors Act. This is the most practical way for minors to “own” property. There is no document or agreement. The statute deals with the responsibility of the custodian to the child. Otherwise, you can have a… |

Trust A trust can be set up for a minor, either separately or by language in a will. The trustee can also transfer property to a custodian (who can even be the trustee) if the trust permits it. But if there is no trust or custodianship, you need a… |

| Guardian A guardianship is often what happens when both parents are deceased without making provisions for how a minor child can deal with property. It’s not absolutely necessary unless real property must be sold or mortgaged, but a court must approve any real estate transaction. |

|

Interest rate increases

Federal Reserve Rate Hikes Likely to Impact Home Mortgage Rates

On March 21st the Federal Reserve FOMC (Federal Open Market Committee) called for the fed funds target rate range to be increased 25 basis points to 1.50%-1.75%. And policymakers are leaning towards two more rate hikes by year end. The Committee now expects a total of six hikes by the end of 2019.

Hikes in the prime interest rate from the Fed, nearly always results in higher interest rates for home buyers. A 1% jump in the interest rate can cost about $23,000 extra on every $100,000 over the life of a thirty-year loan. With two more rate increases considered very likely this year, potential homebuyers will get off the fence and into the market, in order to buy a house before rates go any higher.

|

Anyone currently contemplating applying for a new loan or a refinance should try to lock in a loan at today’s rate as soon as possible. Call me TODAY to get started. |

Can You Buy Your Home With Bitcoin?

Can you use Bitcoin to buy a home? Up until recently, the answer was “no.” But times are changing – slowly. A few transactions have taken place in the U.S. (more elsewhere) and websites that facilitate Bitcoin real estate transactions have launched. We have a long way to go, however. Here’s why:

The Real Estate Transaction is Complicated

You may think it’s obvious when you buy a home that you pay for it, so you own it. But did the seller actually own it? Did he or she buy it from a legitimate seller? You can only count on it because someone traced a chain of title back to the home’s first recorded ownership. This is where real estate and Bitcoin are actually very similar. To trace the chain of title of real estate, the County Recorder keeps meticulous records that go way back in time. Sound familiar? If you understand blockchain technology, it should. Blockchain is the foundation of all digital currencies and is a ledger that records every transaction of every digital coin ever made to track the chain of title and verify current ownership.

Bitcoin and Real Estate Seem Like a Natural Match

What’s holding it up? Well, it’s new and people adopt new technologies slowly. Those involved in real estate transactions struggle with security issues (whether or not a digital currency is valid) and the price volatility of the coins.

Like Bitcoin, Credit Cards Were Not Widely Accepted at First

Digital currency is new and therefore perceived as risky. When credit cards were first introduced, they were, too, and large-scale adoption took quite a few years. But today “plastic” is accepted everywhere.

How Do We Overcome the Resistance?

As for volatility, digital currency is an international currency, so international buyers are less concerned about price volatility than U.S.-based buyers, at least for now. After all, the value of a U.S. dollar fluctuates quite a bit, too, from an international perspective. The dollar only seems stable to us because we only deal in dollars. As digital currencies (which aren’t tied to any national currency) gain traction, we’ll become more accustomed to that notion. As for chain of title, blockchain technology – which ensures the validity of ownership of digital currency – is considered very secure, just like county records. Adoption of Bitcoin in real estate transactions is only a matter of time. For now, though, early adopters are out there.

Manhattan Developer Accepts Bitcoin

A Manhattan real estate developer recently agreed to accept Bitcoin as payment for new condominiums, priced from $700,000 to $1.5 million, he is developing on the Lower East Side. What does he plan to do with the Bitcoins? Buy investment-grade art, of course.

Most title and escrow companies won’t yet accept Bitcoin as a deposit on the transaction or for the down payment.

A developer in Minnesota similarly offered at the beginning of this year to accept Bitcoin for a spec home he has under construction. He hasn’t finished the home yet; we’ll see if he changes his mind. The first-ever true Bitcoin transaction took place in Miami December 2017 when a condominium sold for 17.74 bitcoin. At the time the deal closed, Bitcoin was trading for $15,502 per coin, which represented a value of $275,000. As of this writing, Bitcoin is down to $9,318, so we can only hope the seller cashed out.

What’s Holding Bitcoin Back?

Most title and escrow companies won’t yet accept Bitcoin as a deposit on the transaction or for the down payment. The ones that do accept it so far convert it to cash anyway. Mortgage companies also balk at digital currency. A down payment all in Bitcoin is not acceptable to most lenders, and the seller’s mortgage company will not accept a payoff in it, either. Consequently, to this date all real estate transactions involving Bitcoin have been all “cash” – no mortgage involved.

Tax Consequences of Using Bitcoin

Even if the seller will accept Bitcoin and the title company will work with it in the transaction, you might find yourself with other challenges. If your Bitcoin has appreciated since you bought it, using it to buy something else is the same as cashing it in in the eyes of the IRS. You now owe Uncle Sam some taxes for the capital gain. And they don’t accept Bitcoin. Adoption is coming, however. There is even an organization, called the International Blockchain Real Estate Association, established to promote the use of digital currency in real estate. Founded in 2013, it is “…an educational and trade organization dedicated to implementing blockchain in real estate.” There may come a time when using digital currency to buy real estate is commonplace, but that time is probably a ways off. Maybe you can be the first in your state?

King County Property Tax Increase

The word is out; King County property taxes are going up by double-digit percentages. County Assessor John Wilson says across King County the average tax bill going out this month will be 17% greater than last year’s property tax. This increase is the result of a new school-funding plan that is part of the recently passed budget.

The plan is a response to the state Supreme Court’s landmark McCleary decision, in which the Court ruled that Washington was not adequately funding basic K-12 education. Using increased property taxes to pay for education is part of the budget that was signed by the governor last year.

Wilson admits it’s the greatest increase in some time, and some areas of the county will see larger increases than others. 16.9 percent will be the jack-up amount for Seattle property taxes. It equates to a tax bill that is $825 higher than last year for a median-valued home ($597,000).

The increase in property tax for Bellevue will be 21.6 percent. For the owner of a median-valued home ($791,000) the dollar increase over last year’s tax burden will be $1300. In Federal Way the increase will be 11.5 percent — $434 more for the owner of a median-valued home ($301,000) than the tax figure last year.

Tax increases in Pierce and Snohomish counties won’t be as steep. In Pierce County the owner of an average single-family home valued at $321,000 can expect to pay about $330 more per year. Snohomish County estimates the owner of a $400,000 single family home will pay approximately $330 more in property tax this year over last year. In Marysville the tax jump will be about $400.

Wilson says the Legislature’s education funding plan is putting the heaviest burden on King County homeowners. Last year when the plan was signed into the budget, some lawmakers predicted property taxes would fall in some parts of South King County; Wilson says that is just not true.

Spacer

The New 2018 Tax Law

Homeowners will see a number of key changes take effect in the very near future. If you own property, here’s what you can expect:

Increased standard deduction: The standard deduction would nearly double, to $12,000 for single filers and $24,000 for joint filers. (

If you have a fairly small mortgage, you’ll likely now be using the standard deduction rather than Itemizing on Schedule A.)

Mortgage interest deduction: Assuming the new mortgage is obtained after 1/1/2018, the deduction is limited to the interest on the first $750k of loan amount, down from the current cap of $1 million. Existing mortgages can still deduct up interest on the first $1 million. This new limit will also apply to second homes. BUT you will not be able to deduct interest on a new HELOC (home equity line of credit). Remember, the value of a tax deduction lies in your effective tax rate. The higher your rate, the more valuable the deduction.

State and local tax deduction: Taxpayers will be allowed to deduct up to $10,000 in a combination of property tax and income tax (or sales tax). This impacts about 4 million whose taxes now exceed that $10k limit.

Capital gains exclusion for the profit from sale of a primary residence sale: This deduction will stay the same; you can exclude the first $250,000 of profit ($500,000 if married) if you’ve lived there two of the past five years; and the 1031 like-kind exchange for real property capital gains deferral will also not change .

New individual tax rates: There will be seven individual brackets at 10%, 12%, 22%, 24%, 32%, 35% and 37%. The new 37% top rate will apply to taxable income in excess of $500,000 for single filers and $600,000 for joint filers.

Here are some other changes in the new law:

Increased child tax credit: The per-child tax credit will double from $1,000 to $2,000.

Increased exemption for Alternative Minimum Tax (AMT): The AMT will be retained for individuals, but the exemption and phase-out amounts have sharply increased.

No changes to capital gains and dividends: Capital gains & qualified dividends will continue to be taxed at the current 0%, 15% & 20% rates, depending on income. Wealthier filers will continue to pay an additional 3.8% tax on investment income (Net Investment Income Tax).

Estate tax exemption are doubled: Estates of up to $11 million (or $22 million for couples) will be exempt from taxation.

Some other deductions and tax credits are repealed: including deductions for tax preparation, moving expenses and alimony payments, among others.

The individual mandate that individuals purchase health insurance or pay a penalty is repealed beginning in 2019.

Deduction for medical expenses will be the same: Medical expenses above 7.5% of adjusted gross income will be deductible in 2017 and 2018, rising to 10% in 2019.

No changes to cost-basis rules: Investors will continue to have the ability to choose which lots of stock they are selling. (no requirement for FIFO method)

Expansion of 529 college savings accounts: Up to $10,000 per year of money in a 529 college savings plan can be used to pay for K-12 school tuition or homeschooling.

No major changes to retirement savings accounts: Contribution limits to IRAs, Roth IRAs, 401(k)s and other retirement plans were not changed.

Reduction in taxes for “pass-through” businesses: The bill significantly reduces the effective rate of tax on business income earned by independent contractors and income received from pass-through entities.

Important summary for homeowners:

• The mortgage interest deduction will be limited to $750,000 loans

• Interest on home equity loans will no longer be deductible

• The property tax deduction will be capped at $10,000

New Roof is #1 Investment

The two main reasons home-owners invest in remodeling are 1) to increase the value of the home and 2) to improve their enjoyment and comfort in the home. According to a recent industry report a new roof is still the best investment for both recouping cost and home enjoyment.

The report looks at 20 different remodeling projects (12 interior, 8 exterior) and ranks them by estimated cost, cost recouped at time of sale, and the happiness of the home-owner with the project. One thing it makes clear about remodeling projects is those with the highest appeal to home-owners can have a very low cost recovery figure.

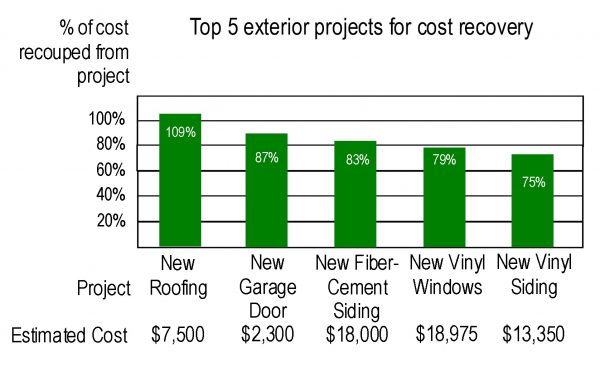

Here are the top five exterior projects for cost recovery:

New roofing not only topped the list of exterior projects for cost recovery, it also beat all interior projects for cost recouped at time of sale. For 77% of those who got new roofing the main reason was to upgrade and replace worn-out surfaces and materials. Of the eight exterior projects examined, the one with the lowest cost recover is new wood windows, with a recouped value at only 57%.

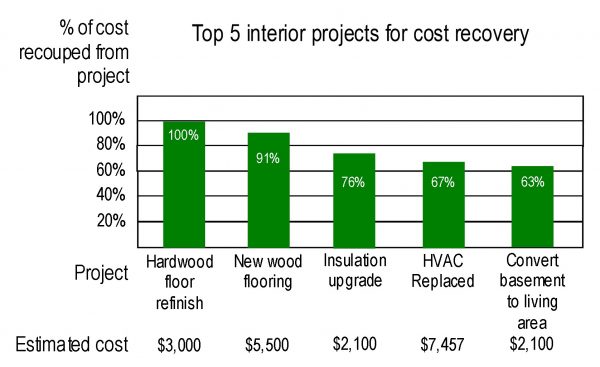

Of the top five interior remodeling projects for cost recover, flooring took the first two slots:

Interior projects prove more likely than exterior ones to have a high owner happiness score and a low recoup value. For example, a new bathroom, or a bathroom renovation, recoups only 50 percent of its cost. Obvious improvements, such as a complete kitchen renovation or the conversion of a basement into living space, deliver recoup percentages in the low sixties.

Click HERE to see the full report.

What Is An ‘Escrow’?

What is an escrow and why is it needed?

An escrow is an arrangement in which a disinterested third party, called an escrow holder, holds legal documents and funds on behalf of a buyer and seller, and distributes them according to the buyer’s and seller’s instructions. In simple terms, escrow is the “safe deposit box” for the transaction.

People buying and selling real estate typically open an “escrow” account for their protection and convenience. In a purchase, the buyer can instruct the escrow company (“Escrow”) to disburse the purchase price only upon the satisfaction of certain prerequisites and conditions. The seller can instruct Escrow to retain possession of the deed to the buyer until the seller’s requirements, including receipt of the purchase price, are met. When a loan is involved (in either a purchase or a refinance) the lender provides Escrow with separate instructions. Both rely on Escrow to faithfully carry out their mutually consistent instructions relating to the transaction and to advise them if any of their instructions are not mutually consistent or cannot be carried out.

An Escrow is convenient for the buyer and seller because both can move forward separately but simultaneously in providing inspections, reports, loan commitments and funds, deeds, and many other items, using Escrow as the central depositing point. If the instructions from all parties to an escrow are clearly drafted, fully detailed and mutually consistent, Escrow can take many actions on their behalf without further consultation. This saves much time and facilitates the closing of the transaction.

Who may hold escrows?

The Escrow may be any disinterested third party (although some states, including Washington, require that certain Escrows be licensed).

There are two important reasons for selecting an established, independent escrow firm, an attorney, or an escrow officer with a bank, S&L or title insurance company. One is that real estate transactions require a tremendous amount of technical experience and knowledge to proceed smoothly. The other is that the escrow holder will generally be responsible for safe-guarding and properly distributing the proceeds of the transaction.

Escrow officers with established firms generally hold a state license andare experienced and trained in real estate procedures, title insurance, taxes, deeds and insurance.

What are escrow instructions?

Escrow instructions are written documents, signed by the parties giving them, which direct the escrow officer in the specific steps to be completed so the escrow can be closed.

Typical instructions would include the following:

• The method by which the escrow holder is to receive and hold the purchase price to be paid by the buyer.

• The conditions under which a lapse of time or breach of purchase contract provision will terminate the escrow without a closing.

• The instruction and authorization to Escrow holder to disburse funds for recording fees, title insurance policy, real estate commissions and any other closing costs incurred through escrow.

• Instructions as to the preparation for insurance and taxes.

• Instruction to Escrow on the payment of prior liens and charges against the property and distribution of the net proceeds of the transaction.

Since Escrow can only follow the instructions as stated, and may not exceed them, it is extremely important that the instructions be stated clearly and be complete in all details.

What does each party do in the escrow process?

The Seller

• Deposits the executed deed to the buyer with the escrow holder.

• Deposits evidence of pest inspection and any required repair work.

• Deposits other required documents such as tax receipts, addresses of mortgage holders, insurance

• policies, equipment warranties or home warranty contracts, etc.

The Buyer

• Deposits the funds required, in addition to any borrowed funds, to pay the purchase price with the escrow holder.

• Deposits funds sufficient for home and title insurance.

• Arranges for any borrowed funds to be delivered to the escrow holder.

• Deposits any deed of trust or mortgages necessary to secure loans.

• Approves any inspection reports, title insurance commitments, etc. called for by the purchase and sale agreements.

• Fulfills any other conditions specified in the escrow instructions.

The Lender (if applicable)

• Deposits proceeds of the loan to the purchaser.

• Directs the escrow holder on the conditions under which the loan funds may be used.

Escrow

• Opens the order for title insurance.

• Obtains approvals from the buyer on title insurance report, pest and other inspections.

• Receives funds from the buyer and/or any lender.

• Prorates insurance, taxes, rents, etc.

• Disburses funds for title insurance, recordation fees, real estate commissions, lien clearance, etc.

• Prepares a final statement for each party indicating amounts to be disbursed for services and any further amounts necessary to close escrow.

• Records deed and loan documents, and delivers the deed to the buyer, loan documents to the lender and funds to the seller, thereby closing the escrow.

What is the division of charges?

The method of dividing the charges for the services performed through escrow, or as a result of escrow, varies from place to place. The fees and service charges to be divided might include, for example, the title insurance policy premiums, escrow fees, any transfer taxes, recordation fees and costs in connection with any loan being obtained. Unless there is some special agreement between the parties as to how these charges are to be paid, local custom will generally be followed in drafting the instructions to the escrow holder as to how they are to be divided.

What is closing the escrow?

Once all the terms and conditions of the instructions of both parties have been fulfilled, and all closing conditions satisfied, the escrow is closed and the safe and accurate transfer of property and money has been accomplished.

In summary

The escrow process was developed to help facilitate the sale or purchase of your home. The escrow holder accomplishes this by:

• Acting as the impartial “stakeholder,” or depository of documents and funds.

• Processing and coordinating the flow of documents and funds.

• Keeping all parties informed of progress on the escrow.

• Responding to the lender’s requirements.

• Securing appropriate title insurance policies.

• Obtaining approvals of reports and documents from the parties as required.

• Prorating and adjusting insurance, taxes, rents, etc.

• Recording the deed and loan documents.

• Maintaining security and accountability of monies owed and owing.

It’s not always this simple

The examples and explanations described here are designed to acquaint you with the escrow process and are based on relatively simple escrows. Every escrow is unique and many can be more complex than explained here. If you have questions about the escrow process, we suggest you contact an escrow officer or attorney to obtain detailed advice and further explanation.

Items needed for a loan submission

Income verification

1. For a W2 wage earner (employed person) provide

a. last two W2s and paystubs for the most recent 30-day period.

b. If the W2 borrower owns rental property, all pages of the last two income tax returns.

2. For an independent contractor (paid by 1099) provide a YTD (year to date) P&L and all pages of the last two income tax returns.

Note: Your lender is required to show independent proof from the IRS that they have ‘received’ and can deliver a 4506-T for your last two years. If you are applying for a loan early in a calendar year, and you want to use the income on last year’s return, you will have to somehow get documentation that it has been submitted. This may require an appointment with the IRS to provide appropriate documentation.

Asset verification:

Copies of ALL pages of the bank account statements for the two most recent months showing sufficient assets to cover any down payment required plus enough to cover reserves and pre-paid items. Reserves and pre-paid items includes monthly payments for insurance on the home (the number of monthly payments depends on whether the loan is for a purchase or refinance), property taxes for two to six months (depending on the month the loan is closed) plus interest on the new loan from the day of closing to the end of that month.

Miscellaneous other requirements:

Closing a loan

When people talk about a real estate purchase or refinance, they sometimes use the terms “signing” and “closing” interchangeably in reference to the event when the buyers sign documents with Escrow . However, there are several events that take place between the buyer’s signing appointment and the actual closing of the real estate transaction. Let’s take a moment and review that process.

Signing of Documents.

Escrow prepares the settlement statement according to the terms of the transaction. When a loan is involved, the lender provides a ‘Closing Disclosure’ to the buyer/borrower for acceptance and signature. There is a three-day waiting period after acceptance, during which Escrow prepares the necessary escrow and title transfer documents. After the required waiting period, the lender will then forward the documents for signature to Escrow, so that the signing appointments can be scheduled. There is no required waiting period if a loan is not involved.

Lender Reviews Documents & Funds the Loan

Once the loan documents have been signed, the Escrow delivers them back to the lender either by email, fax or physical delivery for review. When the lender is satisfied that all required documents have been signed and all outstanding loan conditions have been met, the lender will notify Escrow that they are ready to disburse the loan funds to Escrow. Upon receipt of the wire transfer of funds from the lender, Escrow is authorized to send the transfer documents to the county for recording. The time frame for lender review is normally 24 to 48 hours.

Excise Tax

Real estate transactions in Washington State that involve conveyance or transfer of property require consideration of Excise Tax. All appropriate tax amounts must be paid before the county will allow the Warranty Deed conveying title to be recorded.

Recording is Authorized

Once recording is authorized by the lender, and all funds have been received, documents are either electronically recorded or hand-carried to the county recorder’s office by the title insurance company. If there are any liens to be paid off, those payoffs are recorded first, then the Warranty Deed showing the transfer of the property to the buyer, with the Deed of Trust recorded next. Recording the Deed of Trust just after the Warranty Deed insures the lender’s first lien position on the property. In a refinance, there is no Warranty Deed to be recorded.

Closed and Recorded

Recording numbers are the unique and specific numbers given by the county recorder’s office to a properly executed legal document, thereby making it part of the public record. In other words, when recording numbers are received by Escrow, the buyer is “on record” as holding title to the property and, based on the possession date in the purchase agreement, the new owner may take possession and proceeds may be disbursed to the seller.

|

Ed Irwin, JD, CMC Loan Originator/Attorney (425) 466-8900 |

Ed@EdIrwinMtg.com www.EdIrwinMtg.com NMLS #115682 |

NMLS Identifier #893532 |

| Your mortgage COACH™ | |||